Singapore Tours

![]()

|

Around the world |

| ZOO | BOTANICAL | BIRD PARK | MUSEUM |

| RESORTS WORLD |

|

||

| SENTOSA | |||

| MARINA BAY SANDS | HAW PAR VILLA | ||

|

|

|

|

|

|

|

|

|

|

(1) (1) MARINA BAY SANDS Opening date Grand opening - 17 February 2011 No. of rooms 2,561 Permanent shows Signature attractions

Sands SkyPark Notable restaurants

CUT Casino type Land-Based Owner Las Vegas Sands Corp Website marinabaysands.com BACKGROUND LVS submitted its winning bid on its own. Its original partner City Developments Limited (CDL), with a proposed 15% equity stake, pulled out of the partnership in the second phase of the tender process. CDL's CEO, Kwek Leng Beng said his company's pullout was a combination of factors - such as difficulties in getting numerous companies he owns to comply in time, as well as reluctance of some parties to disclose certain private information in probity checks required by the Singapore government. However, Kwek was retained as an advisor for Sands' bid. INVESTMENT Las Vegas Sands initially committed to invest S$3.85 billion in the project, not including the fixed S$1.2 billion cost of the 6,000,000 square feet (560,000 m2) site itself.[14] With the escalating costs of materials, such as sand and steel, and labour shortages owing to other major infrastructure and property development in the country, Sheldon Adelson placed the total cost of the development at S$8.0 billion as of July 2009. DESIGN The resort is designed by Moshe Safdie, who says it was initially inspired by card decks. In addition to the casino, other key components of the plan are three hotel towers with 2,500 rooms and suites, a 200,000-square-foot (19,000 m2) ArtScience Museum and a convention centre with 1,200,000 square feet (111,000 m2) of space, capable of accommodating up to 45,000 people. The resort's architecture and major design changes along the way were also approved by its feng shui consultants, the late Master Chong Swan Lek and Master Louisa Ong-Lee.[19][20] The Engineering for the project was headed by Arup and Parsons Brinkerhoff (MEP/ELV). Arup had originally worked on such prestigious projects such as the Beijing National Aquatics Centre and the Sydney Opera House. In spite of their experience, they described the integration of the varied and advanced technologies as the 'most difficult to carry out in the whole world'.[21] The extensive background music system was installed by Singapore based contractor Electronics & Engineering Pte Ltd. Moshe Safdie designed an Art Path within the resort, incorporating seven installations by five artists including Zheng Chongbin, Antony Gormley, and Sol LeWitt. The pieces are meant to play on environmental influences including light, water and wind, integrating art with architecture. Las Vegas Sands declared the undertaking as "one of the world's most challenging construction projects and certainly the most expensive stand-alone integrated resort property ever built". It expects the casino to generate at least $1 billion in annual profit. GRAND OPENING Marina Bay Sands was originally planned to be completed in a single phase in 2009, but rising construction costs and the financial crisis forced the company to open it in phases. The first phase's preview opening was further delayed until 27 April 2010, and the official opening was pushed back to 23 June 2010. The rest of the complex remained under construction and was opened after a grand opening on 17 February 2011. Marina Bay Sands features three 55-storey hotel towers which were topped out in July 2009. The three towers are connected by a 1 hectare sky terrace on the roof, named Sands SkyPark. THE SKYPARK The SkyPark is home to the world's longest elevated swimming pool, with a 146-metre (478-foot) vanishing edge, perched 191 metres above the ground. The pools are made up of 422,000 pounds of stainless steel and can hold 376,500 gallons (1424 cubic metres) of water. The SkyPark also boasts rooftop restaurants such as The Sky on 57 (by Justin Quek), nightclubs such as KU DÉ TA, lush gardens, hundreds of trees and plants, and a public observatory deck on the cantilever with 360-degree views of the Singapore skyline. SkyPark Engineering Facts Skypark length 340 m Steelwork tonnage 7,700 tons (permanent) & 4,400 tons (temporary)Cantilever length 65 m Cantilever weight 3,500 tons Lifting of cantilever structure13 week. There are four movement joints beneath the main pools, designed to help them withstand the natural motion of the towers, and each joint has a unique range of motion. The total range of motion is 500 millimetres (19.68 inches). In addition to wind, the hotel towers are also subject to settlement in the earth over time, so engineers built and installed custom jack legs to allow for future adjustment at more than 500 points beneath the pool system. This jacking system is important primarily to ensure the infinity edge of the pool continues to function properly THE SHOPPES The Shoppes at Marina Bay Sands also boasts close to 1,000,000 square feet of retail space with over 300 stores and F&B outlets, including numerous luxury duplexes for boutiques such as Ralph Lauren, Chanel, Cartier and Prada. Other luxury stores include Gucci, Hermès, Emporio Armani, Chopard, Burberry, REDValentino, Dior, Dunhill, Vertu, Miu Miu, Yves Saint Laurent, Salvatore Ferragamo, Montblanc, Blancpain, an Hermès Watch Boutique, and Herve Leger. The Rain Oculus above the shopping mall canal. A canal runs through the length of the Shoppes, in the same style as the Venetian in Las Vegas. Sampan rides on the canal are available for guests and shoppers at the shopping mall, similar to the gondola rides available in the Venetian. Also housed within the Shoppes are the six of the seven Celebrity Chef Restaurants - Cut (by Wolfgang Puck), Waku Ghin (by Tetsuya Wakuda), Pizzeria and Osteria Mozza (by Mario Batali), Guy Savoy (by Guy Savoy), DB Bistro Moderne (by Daniel Boulud), and Santi (by Santi Santamaria). Two notable attractions of the resort are the two Crystal Pavilions. Despite a brief legal dispute in June 2011, it has been decided that one of the Pavilions will house two internationally-renowned nightclubs - Avalon and Pangaea. In addition, the second Pavilion will house the world's largest Louis Vuitton boutique, in addition to being on a floating island, at 20,000 square feet, which will be connected to the portion of the boutique in the Shoppes via an underwater tunnel. The Sands Theatre and Grand Theatre seat over 1900 people and 2200 people respectively, with The Lion King showing at the former, and international acts, such as Cirque Éloize and A. R. Rahman's Jai Ho, located in the latter during their world tours. Set next to the theatres is an ice skating rink measuring 6,500 square feet, rivaling that at the Rockefeller Center in New York. http://en.wikipedia.org/wiki/Marina_Bay_Sands

http://vimeo.com/15321159 SKYPARK POOL

http://www.marinabaysands.com/Singapore-Entertainment/Activities/Sands-Skypark/

http://www.scribd.com/doc/40220526/Marina-Bay-Sands-Sky-Park-Cantilever

http://ccojet.wordpress.com/2010/07/13/marina-bay-sands-skypark/ RELATED NEWS: New CEO looking for more land to expand MBS George Tanasijevich gets the top job and is eyeing parcels of land near IR to stay ahead of demand By LEE U-WEN (SINGAPORE) Marina Bay Sands (MBS) has again called on the Singapore government to make available several adjacent plots of land that would help support the US$5.7 billion integrated resort's (IR) burgeoning operations.

These are land parcels currently not on the reserve list, which means they are not positioned to go through the public tender process, said the company's newly-appointed president and chief executive George Tanasijevich. 'The ramp-up here in each of our business lines has been very rapid. We want to be ahead of the demand to make sure that we're not constrained as we continue to progress and build our business,' he said in an exclusive interview with BT, his first since being promoted to the top job this week. His comments come five months after parent company Las Vegas Sands' (LVS) chairman and CEO Sheldon Adelson said that MBS craved more land to cater to the growing demand for its meetings, incentives, conventions and exhibitions (Mice) events, among various business activities. Mr Tanasijevich, 50, said that the strong desire of MBS - which opened its doors in April 2010 - to expand further was 'a signal of just how optimistic we are about Singapore and our business prospects'. 'We encourage the government to move forward with parcels that are adjacent to MBS. We think we could further enhance this part of Singapore, consistent with the overall masterplan for the Marina Bay area,' said the American. Mr Tanasijevich, who will relinquish his position as MBS's managing director of global development, had been the interim CEO since February following the surprise departure of previous chief Thomas Arasi after just 18 months at the helm. MBS will make an official announcement regarding Mr Tanasijevich's new appointment today. The new CEO was LVS's senior representative and main coordinator during Singapore's IR bidding process in 2005. A lawyer by training, he was the first employee to receive the news from the Singapore Tourism Board (STB) that LVS was successful in its bid. In its first full year of operations, MBS welcomed some 19.6 million local and foreign visitors, a large chunk from key markets such as Indonesia, Malaysia and China. Since it opened, the company has also inked deals to host 1,959 Mice events, including those that have already taken place. For the first three months of this year, MBS reported a 48.6 per cent profit margin and pre-tax profits of US$284.5 million, down from US$305.8 million in the previous quarter. The second-quarter results were announced yesterday in the US (Wednesday morning, Singapore time) after the markets closed. 'We want to continue to build on our good start. We want to get better in every aspect of our business and deliver stronger results across the board. You have seen some of the economic impact stimulated by the introduction of the IRs, and we want to keep pushing that to higher levels,' said Mr Tanasijevich. 'Obviously, Asia is an exciting part of the world to be in now. Some of the world's strongest economies are here, not least of which is Singapore with its 14.5 per cent growth last year.' Driving much of MBS's long-term expansion will be its ability to bring in the best talent and placing them at all levels of the company, he said. MBS employs some 8,600 staff today and Mr Tanasijevich said there was some scope to recruit more people with several sections of the casino-resort - including two new crystal pavilions - yet to be opened. 'Over time, as people grow in our business and they get better at their job and rise up the ranks, we will become a more localised company, more of a Singapore company. This is something which I think is important for us to be established here,' he said. Mr Tanasijevich, who has been based here for the last 10 years, described his working relationship with the key government agencies - among them the Ministry of Community Development, Youth and Sports and the Casino Regulatory Authority (CRA) - as a 'constructive and collaborative' one. 'I speak with them by phone on a daily basis. We have regularly scheduled meetings with different groups such as the Integrated Resorts Working Group which is chaired by STB (Singapore Tourism Board) CEO Aw Kah Peng,' he said. 'We meet routinely with CRA to update them on the progress and status of our business. The communication lines are always open and they run both ways.' When asked to reflect on his journey so far having been involved with MBS since day one, Mr Tanasijevich preferred to look ahead to the future and focus on dealing with the immediate tasks at hand in his new capacity. He said: 'I think we are in a situation where this is a privileged position that Singapore has granted us. We want to earn our keep every single day, doing everything we can to help the government and STB meet its goals and objectives and, at the same time, providing economic growth and career opportunities for Singaporeans.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hotels Six hotels, six different experiences Six hotels with six unique themes; it’s like waking up to six different holidays. Resorts World Sentosa offers 1,800 rooms at its hotels, each with a distinct personality, but all sharing a touch of warm hospitality.

LOCATION OF HOTELS http://www.rwsentosa.com/language/en-US/MAPS UNIVERSAL STUDIOS http://www.rwsentosa.com/language/en-US/MapsUSS RESORT WORLD SENTOSA OVERVIEW http://www.rwsentosa.com/LinkClick.aspx?fileticket=G9QHvFhe6y0%3d&tabid=87&language=en-US SENTOSA HOUSING PROJECTS- SENTOSA COVE , OCEANFRONT …ETC

Sentosa Cove (Chinese: 升涛湾) is a residential enclave in the East of Sentosa Island in Singapore, eventually housing about 2,500 units when fully developed. Largely made-up of reclaimed land, it is being marketed as a "exclusive oceanfront residential community" and the "only true seafront residential property" in Singapore. Sentosa Cove is located on the southern-eastern side of Sentosa Island, at the southern most tip of mainland Singapore. Located on the tranquil eastern coast of Sentosa Island, Sentosa Cove is Singapore's first and most exclusive marina residential community that offers tropical resort living just minutes from the hustle and bustle of city life in mainland Singapore. First conceptualised by Bernard Spoerry who designed the renowned Port Grimaud in France, Sentosa Cove's master plan was subsequently updated by McKerrell Lynch Architects from Australia and Klages, Carter & Vail from America into one of the world's most prestigious marina residential communities, blending modern and innovative residential design with the natural tropical environment. Renowned for its world-class infrastructure and political stability, Singapore also boasts a vibrant arts and cultural scene, as well as exciting leisure and entertainment amenities. The master developer of the site is Sentosa Cove Pte Ltd, a subsidiary of Sentosa Development Corporation. The latter purchased the site from the Singapore Land Authority for a sum of about S$800 million. Geography Sentosa Cove is divided into two main areas, the North Cove, and the South Cove. Each cove comprises both bungalow and condominium residential plots, with most units configured to either face the artificially-created sheltered waterways, or the open sea. Straddling between the two is a planned commercial area, known as the Marina Village, which includes a hotel and a marina. NORTH COVE The North Cove has three artificial islands called Coral Island, Paradise Island and Treasure Island, all of which are surrounded by an artificial marina enclosed by an outer ring of reclaimed land. Collectively, the North Cove will have 1,528 residential units: 214 bungalows, 30 terraced houses, and 1,284 condominium units. There are six condominium sites, of which four were successful sold to private developers. The Azure by Centrepoint Homes, and The Oceanfront @ Sentosa Cove by City Developments Limited each held very successful sales campaigns, with units being booked very rapidly even before their respective launches in 2006. Two other plots, known as the Berth by the Cove (awarded to Ho Bee Group) and the Baywater Collection of three condominium parcels, were expected to be launched soon. There are also two significant sites for landed housing, namely the Hillside Collection, and the Lakefront Collection. SOUTH COVE Bungalow plots in the South Cove were launched only in the second half of 2006 after the successful sale of most plots in the North Cove, with an eventual total of 156 units. Another 816 condominium units in four sites are also to be sold, for a total of 972 homes in the South Cove. Demand for these homes is expected to be higher than in the north due to the better sea views offered. With a geographic configuration similar to the north, it also has a sheltered waterway with two artificial islands (Pearl Island and Sandy Island). DevelopmentAbout 60% of the buyers are foreign. It has 2 main views: 1) the world's 2nd busiest port. or 2) one of the world's busiest shipping lanes. About Sentosa Cove When Sentosa Cove unveiled its first land parcels for sale in 2003, it signalled a new era of luxury living in Singapore. For the first time, homes could be built right on the waterfront and residents could look forward to the frills of an active marina lifestyle in Singapore's cosmopolitan community. Today, Sentosa Cove is home to an impressive showcase of prestigious developments, from luxury highrise apartments to tranquil terrace homes and bungalow masterpieces. In the early 1990s, a few officials from Sentosa Development Corporation (SDC) travelled to Port Grimaud, a very successful waterfront development in St Tropez, France, on a study trip. In 1992, SDC invited French architect Bernard Spoerry whose father, Francois, was the creator of Port Grimaud, to assist draw up a masterplan for the development of Sentosa Cove. SDC needed to refine Spoerry's original masterplan as certain aspects did not bond with the physical features of the Sentosa Cove site with the task given to McKerrell Lynch Architects (MLA) from Australia. Besides enhancing the appeal and privacy of the residential developments, MLA explored the commercial possibilities of Sentosa Cove in anticipation that the marina would to become a vital nexus of activity for the Cove residents as well as the public. In 1996, SDC appointed American architectural from Klages, Carter Vail & Partners to look into tropicalising the architecture of Sentosa Cove's development style. Principal architect David Klages envisioned and styled Sentosa Cove as a lifestyle community in the manner of similar waterfront estates in California and Florida. The land sale programme was initially planned to begin in 1994 but was pushed back several times due to the unfavourable property market conditions then. Eventually a bold worldwide marketing strategy, spearheaded by Ms Jennie Chua, Chairman, Sentosa Cove Private Limited (a wholly-owned subsidiary of SDC set up to develop, manage and market the Cove development), saw land values of Cove property rise from an initial price of just over S$300 per square foot per plot ratio (psf ppr) for the first bungalow land parcel in 2003, to an astonishing S$1,820 psf ppr by the time the last high rise parcel was sold in 2008. SDC emphasised on Singapore's global reputation as a safe place to work, invest and live to distinguish Sentosa Cove from other worldwide luxury property developments. SDC also mooted several policy changes to make it possible and attractive for foreign high-net worth individuals to purchase and build homes on Sentosa Cove. In 2004, Singapore government amended the law to allow foreigners to purchase property on Sentosa Cove so long they live on the Cove property and does not own more than one restricted residential property in Singapore. The following year, it introduced a financial investor scheme that granted Permanent Residency to applicants who invested at least S$5 million in financial assets including one Sentosa Cove bungalow property. In 2006 Christie's Great Estates was brought in to auction 12 oceanfront, waterway and fairway bungalow land parcels. This was another milestone for SDC as it propelled Sentosa Cove to international prominence. The auction on the 25th August, helmed by award-winning auctioneer Graeme Hennesy, was broadcasted live to oversea bidders in Australia, Hong Kong, Indonesia, England and Malaysia to enable potential buyers to closely monitor the bidding situation and response accordingly with the capacity crowd close to 400 people. SDC adopted the sales method of awarding a land parcel by Expression of Interest (EOI) for the islands in the southern precinct. It enabled SDC to bring in foreign property developers to Sentosa Cove for the first time. The government also relaxed certain regulations to make it easier for the foreign developers to participate in the Cove land sales. Malaysian developers YTL Corporation Berhad, IJM Properties Sdn Bhd and China developer Ximeng Land, were awarded various Cove projects via such innovation. South Precinct / North Precinct / Central Marina Precinct Sentosa Cove covers an area of 117-hectares mostly made up of reclaimed land, including 5 artificial islands namely Coral, Paradise, Treasure, Sandy and Pearl. Most of the land is designated for residential accommodation, with the 5 islands reserved for bungalows. The residential developments are clustered in three main areas, namely the northern precinct (North Cove), the southern precinct (South Cove) and the central marina precinct. Straddling between the two coves is the central marina precinct, which includes The Residences at W Singapore Sentosa Cove (228 units by City Developments Ltd), W Hotel, ONE°15 Marina Club and The Marina Collection (124 units by Lippo Group). Within the North Cove, there are a total of 829 units in the 4 condominiums, namely The Azure (116 units by Frasers Centrepoint Homes), The Berth By The Cove (200 units by Ho Bee Group), The Coast At Sentosa Cove (249 units by Ho Bee Group) and The Oceanfront @ Sentosa Cove (264 units by City Developments Ltd & TID Pte Ltd). The landed housing on the North Cove includes Coral Island (21 villas by Ho Bee Group), Paradise Island (29 villas by Ho Bee Group), Treasure Island (19 villas by private owners), Kasara Lake Collection (13 villas by YTL Corporation), Ocean 8 (8 terraces by IJM Properties Sdn Bhd), The Berthside (8 terraces by Ho Bee Group), Villas @ Sentosa Cove (8 terraces by ACT Holdings Pte Ltd) and others. Over at the South Cove, there are a total of 563 units in another 4 condominiums, namely Turquoise (91 units by Ho Bee Group), Seascape (151 units by Ho Bee Group & IOI Properties), Pinnacle Collection (280 units by Ho Bee Group & IOI Properties) and Seven Palms Sentosa Cove (41 units by SC Global). The landed housing comprises of Sandy Island (18 bungalows by YTL Corporation & LP World), Pearl Island (19 bungalows by Ximeng Land Pte Ltd), Elevation Golf Villas (20 strata-landed by Elevation Developments) and others. http://www.propertyedge.com.sg/sentosa-cove Development Guidelines & Planning Parameters The Residences at W Singapore Sentosa Cove The Oceanfront – Landmark Living by the Sea Surrounded by 360 degrees of spectacular beauty, The Oceanfront @ Sentosa Cove is a stunning architectural landmark by the sea that commands the highest views on Sentosa Cove. Located just minutes away from the Marina Club and the proposed Integrated Resort, be spoilt for choice with the finest array of dining, entertainment and retail offerings. Revel in a world-class marina lifestyle, or tee off at one of two championship golf courses. Live the good life. Experience the ultimate in true seafront living right here at The Oceanfront. Azure seas. Acclaimed golf courses. Nature in all her resplendent glory. The city just 10 minutes away. A marina at your doorstep. This is Sentosa Cove, one of the world’s most exclusive oceanfront residential community. Dive into the ultimate luxury of this world-class development, nestled on Sentosa island’s eastern shores, and a sanctuary you can truly call home. Design your own living space on generous land parcels that offers a wealth of opportunity for the individualistic and bold. Savour the luxury of modern living at the Marina Village – where wining, dining and shopping are just a stone’s throw away from your front lawn. And have we mentioned Sentosa Cove Marina, Asia’s finest yachting hub and meeting point for the world’s yachtsmen? Come, sail home to Sentosa Cove. An Integrated Marina Lifestyle This exclusive luxury water-edge condominium is seated regally at the northern gateway to Sentosa Cove. The Oceanfront which resembles a shimmering sculpture will be the icon to captivate seafarers as they sail along the Singapore Straits to Sentosa Cove. The outstanding modern marine architectural design of The Oceanfront by internationally celebrated Wimberly Allison Tong & Goo Inc. will be the welcoming beacon for Sentosa Cove. Standing 15-storey tall, The Oceanfront will be the tallest residence in Sentosa Cove. Privileged residents enjoy not only the best views on the island, but also the incredible views of the immense sea and charming marina in this exclusive enclave. Location:

Sentosa Cove (District 4) There are condominiums but none quite like those at Sentosa Cove. These unique waterfront residences combine the best in condominium living with the added luxury of private berthing options. Enveloped in tranquillity, the low-rise apartments offer an exclusive resort village ambience. The two condominium towers, on the other hand, reach boldly for the sky and are a prominent landmark. They offer an unrivalled and unobstructed view of the seascape, with views of the Southern Islands and beyond that, the deep waters of the South China Sea. Sentosa Cove Landed Sales Transactions Year 2010

Year 2009

Foreigners hot for Sentosa Cove bungalowsMar 31, 2011

The number of foreigners buying bungalows in Sentosa Cove has increased, while other pricey locations in the city have experienced a decline. The number of expats in Singapore who are purchasing bungalows in pricey locations in the city, including Districts 10, 11 and 21, fell last year, compared with the preceding year. The number of detached houses purchased by foreigners in these three districts in the past year was generally much lower than in the 2006 and 2007, which were the peak years of foreign purchasing of Singapore property. Meanwhile, in District 4 where Sentosa Cove is located, both the percentage share of bungalows purchased and the absolute number of bungalows bought by foreigners scaled fresh heights last year, according to CB Richard Ellis (CBRE). Tan Tiong Cheng, Chairman of Knight Frank, attributed the divergent trends in foreigners purchasing upmarket bungalows in mainland Singapore against Sentosa Cove to the fact that fewer foreigners were awarded permanent resident (PR) status in the previous year, compared with 2009.

Last year, the government approved only 29,265 PR passes, less than half the 59,460 passes given out the year before. This represented the lowest PR intake in the last five years. “One of the criteria for a foreigner to be granted approval to buy a landed home on mainland Singapore is that he or she has to be a Singapore PR (making adequate contribution to Singapore's economy). And even those who are PRs may have faced stricter criteria in getting approval to buy landed homes last year,” Mr. Tan suggested. Mr. Tan added that foreign purchasing at Sentosa Cove continued to strengthen because it is the only location in Singapore where foreigners who are not PRs are permitted to own a landed home.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(4) CLARKE QUAY – REDEVELOPMENT SEE MAP FOR SINGAPORE RIVER LOCATIONS http://www.streetdirectory.com/asia_travel/travel/travel_id_7311/travel_site_22433/5/

Clarke Quay, Boat Quay & Robertson QuayThe 3 quays are the epitome of alfresco dining by the iconic Singapore River after dusk falls. You will be thoroughly spoilt for choice when looking for a suitable place to dine. Though there is a good mix of bars and restaurants at each of the quays, the atmosphere and design certainly differ. Clarke Quay (A)Clarke Quay brings in arguably the largest crowds on weekend evenings. Consisting of five restored warehouses, bars and restaurants now dominate the scene, perfect for bar-hopping under one plastic, jelly-looking roof. Visiting Clarke Quay on weekends, you'll notice almost every inch of space along the riverside promenade taken up by the locals, expatriates and tourists. The bars are packed with people looking for a fantastic night out with friends, and live music can occasionally be heard through the bustling crowds. Riverside Point, a small shopping mall, is located on the opposite bank to the main Clarke Quay warehouses. A large seafood restaurant, Jumbo, offers another dining option to all the bars. Brewerkz the microbrewery famous for superbly brewed on site beers is next door. Read Bridge connects the two banks, with makeshift stalls set up during festivals like Chinese New Year choosing to locate here. The centre of the bridge offers you a great photo opportunity, though the huge crowds can be a put-off. Starting in March 2010, every first Thursday night from 7.30pm till 10pm, be treated to live music from the best jazz bands at Central Square while you are dining and enjoying your night out. Getting There - Take a train and alight at Clarke Quay MRT station. You'll exit through a new shopping mall called Central before reaching Clarke Quay. http://www.clarkequay.com.sg/store_jetty.htm Boat Quay (B)This portion of the riverside can stake its claim to be the most photographed area of Singapore. A row of carefully conserved shophouses fronts a backdrop of towering skyscrapers. Today, these shophouses have been converted to sports bars, pubs, seafood restaurants and other alfresco joints. Boat Quay tends not to be as crowded and rowdy as Clarke Quay, though it is the expatriate's choice for simply relaxing and having a drink. Boat Quay was once the main focal point of Singapore's entrepot trade business. Sir Stamford Raffles, Singapore's founder, first landed on the banks of Boat Quay, near the present-day Cavenagh Bridge. Cross the bridge to the spacious promenade of the opposite bank. The Asian Civilisations Museum is located here, together with the Victoria Concert Hall and Theatre. There are 2 restaurants worth a visit here. Indo-chine, the posh, romantic place serving Asian cuisine and Timbre, a great place for a drink while enjoying the live music every night. Getting There - Take a train and alight at Raffles Place MRT station. Take Exit G within the station to reach Boat Quay on the bank opposite the Asian Civilisations Museum. Robertson Quay (C)

The quiet cousin of Clarke and Boat Quay, Robertson Quay is a laid back, tree-lined stretch perfect for those who simply want a break from the loud music and crowds. Compared to Clarke Quay, the greenery extends to even within alfresco areas, with lamps on tree branches providing warm lighting for a quiet dining experience. In fact, late-night goers are particularly attracted to the inner courtyard joints. However, if you only have one night to visit Robertson Quay, it is best to pick a restaurant of your liking just by the river for a tranquil dinner. Cafe Brio's of the Grand Copthorne Waterfront Hotel offers tables just 2 steps away from the river, serving international cuisine in a neat setting. Brussels Sprouts offers fresh, live imported mussels and shellfish accompanied with a variety of Belgian beers unique to the restaurant. Though this quay is the least touristy of the 3, this party strip has recently surpassed even Clarke and Boat Quay. You'll find numerous pubs and dance clubs, each with its unique theme and style. Furthermore, most clubs do not have a cover charge, which is perfect for late-night clubbers looking to club-hop for free. Getting There - Robertson Quay is a good 15 minute walk from Clarke Quay MRT station. Alternatively, take bus service 123 from Orchard Road and alight along Havelock Road.

HISTORY OF BOAT QUAY The history of the Singapore River can be divided into three distinct periods: pre-colonial, colonial and post-colonial. Colourful tales permeate the pre-colonial history of Singapore River. The Urban Redevelopment Authority (URA) undertook the planning of the Singapore River. New developments have become a palimpsest over old histories. When Singapore was founded by Sir Stamford Raffles, the river was home to the many merchants, businessmen and coolies, who were the forefathers of Singapore. This is the very origin of Singapore's prosperity, with the Merlion (the city's tourism icon) steadfastly standing guard at the mouth of the river. Quaint bridges span the river, ranging from the elegant Anderson Bridge to the simple Ord Bridge. Heading upriver, you will see the historic Anderson and Cavenagh Bridges. Cavenagh Bridge, built in 1869 and now for pedestrians only, leads to Empress Place, which was named in honour of Queen Victoria. At Empress Place, you will find the elegant Victoria Concert Hall, where classical concerts by the Singapore Symphony Orchestra are held regularly. Highlights on the banks of the Singapore River include Boat Quay, Clarke Quay and Robertson Quay, landmarks and memorials such as Merlion Park and Parliament House, museums such as the Asian Civilisations Museum as well as temples and mosques such as the Tan Si Chong Su Temple and Omar Kampong Melaka Mosque. Boat Quay known previously as Public Quay, the row of shophouses here used to be a hub of commerce and trade. After undergoing careful restoration as a conservation area in 1989, Boat Quay is today a choice destination for al fresco dining and merry-making, with restaurants and pubs lining the promenade. Reclaimed from swamps in 1822,

Boat Quay was the first area along the Singapore River developed to

provide commercial and warehousing facilities for the thriving entrepot

trade. The Chinese refer to it as the ‘belly of the carp’ as its

location at the bend of the river resembles one. Traditional Chinese

beliefs regard the fish’s belly as the place where good fortune resides.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

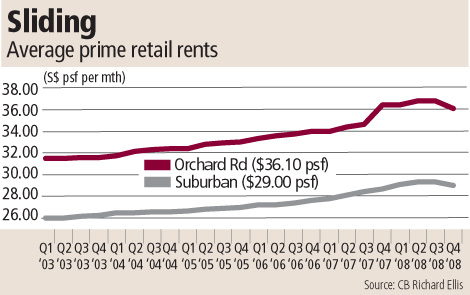

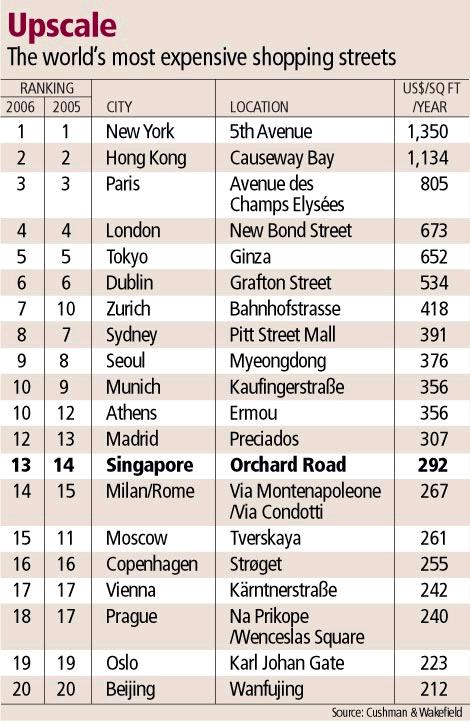

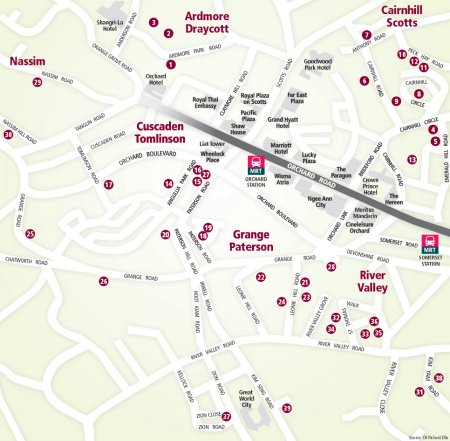

(4) ORCHARD ROAD- GRADE A RETAIL – ION ORCHARD..ETC Orchard Shopping Heading the list of shopping malls in Singapore are the Orchard road centric places such as: Ion Orchard - largest shopping mall along Orchard Road Takashimaya Singapore - brand names like Chanel, Coach and Tiffany & Co. Tangs - A historic store that you must visit in Orchard Road is the . It epitomizes true rags to riches tale and today is at par with any international store. Centrepoint Shopping Centre Lucky Plaza - not so glitzy but you can get some great bargains here in electronics, shoes and clothes. Far East Plaza - popular with fashion conscious youngsters who like street fashion and tattoos. Plaza Singapura The Palais Renaissance mall at Orchard Road is a venue for indulgent decadence with its famous stores like Prada, DNKY, besides the Mumbai Se store which retails top notch Indian fashion labels. Designer American brands can be found at Paragon, Wisma Atria and Plaza Singapura which also anchors the Carrefour Department Store. Isetan at the Shaw House is another place for food, specially Japanese cuisine items, and fashion. Other popular shopping jaunts for the hoi polloi are the older malls in Orchard as they have more reasonable range of goods. For example the Specialists Shopping center houses the reasonable retail store - John Little. The Forum Mall (Orchard) is a kid’s dream store as it houses the immensely popular Toys R Us store. For music look no further than Pacific Plaza which has Tower Records and the Heeren, also on Orchard which has the HMV store. A good place for affordable fashion and fashionable dining is the renovated Parco Bugis Junction which has become popular with the younger generation. Other top end malls to visit in Singapore are the Suntec City Mall, Harbour Front Mall, Raffles City Shopping Centre, the Marina Square and the Millenia Walk. Millennia Walk’s famous stores include Fendi and Liz Claiborne. The Park Mall and The Furniture Mall offer great design ranges for your home. Ion Orchard In a city known for its shopping, Ion Orchard does not disappoint as it hosts numerous shops ranging from high profiles designers to the chain stores everyone is familiar with. Not only does Ion Orchard boast a wide range of stores, but it is also located within Singapore's most prominent shopping district, Orchard Road. Sitting high on Orchard Road, it is one of the most innovative buildings in the city. With sky entrances, spectacular architecture, and numerous modern attractions, Ion Orchard provides a jaw-dropping experience even for those not interested in shopping. Any Singapore shoppers interested in a fabulous shopping experiences knows to head to Orchard Road. With hundreds of high end retail locations and great dining around every corner, Orchard Road is Singapore's most luxurious shopping avenues, and Ion Orchard has spared no expense to make sure that it provides Singapore shopping customers with the high quality shopping experience they expect. The Largest Shopping Mall at Orchard Road Ion Orchard is not only the largest shopping mall along Orchard Road, but it is also the most premier shopping center. With high profile designer stores located throughout the building, Ion fashion is of top priority at Ion Orchard. Crumpler, Havaianas, Valentino boutique, Giorgio Armani, and Salvatore Ferragamo are all Ion Orchard shops, and shoppers can freely purchase a wide variety of their merchandise while finding exceptional quality and receiving a world class shopping experience. Ion Orchard shops allow shoppers to find a variety of fine designer clothing and handbags along with many other distinguishable items all under one roof. In fact, providing a superior selection is so important to Ion Orchard that the shopping center houses over 100 different stores. There is never a moment for a shopper to be disappointed with so any shops available. In addition to a large variety of shops, Ion Orchard also offers a plethora of dining experiences. While shoppers scour the stores of ion Singapore including Louis Vuitton, Shu Uemura, and Dolce & Gabbana, they can also take a break to enjoy the Ion food court that has nearly 70 different food establishments available.

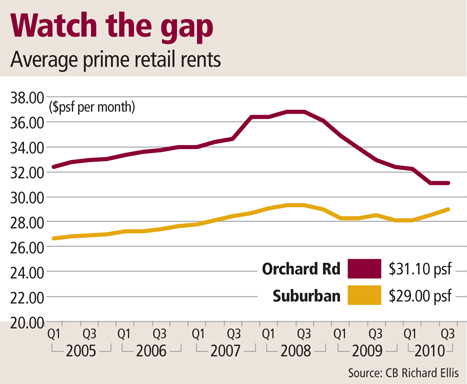

When shoppers first being their Singapore shopping experience, they should always consider heading to Ion Orchard on Orchard Road for one of the best and most hassle free shopping experiences available. Ion Orchard provides everything a person would need under one roof, and prides itself on its excellent service making it a great first stop for any first time Singapore shopper. Orchard Road ranked 27th most

expensive retail street in world: survey SINGAPORE : Singapore prime

Orchard Road shopping belt has been ranked the 27th most expensive

retail street in the world by property consultant Colliers

International. Orchard Road, Singapore's highest rent retail

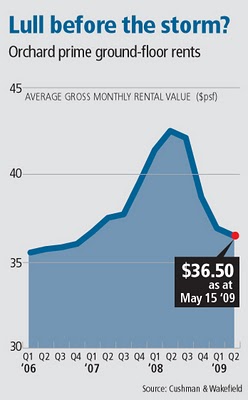

district attracts $45 million renovation on Orchard Road Rents for ground floor shops in Orchard Rd hold up The heat is on for Orchard Road retail rents with declining retail sales and substantial new supply completing soon, but Cushman and Wakefield says opportunistic retailers entering the final stages of negotiations for limited remaining choice ground-floor spots in new malls have kept demand for prime retail space firm in the first six weeks of this quarter. The average monthly rental value for prime street-level retail space on Orchard Road dipped 1.1 per cent in the six weeks between end-Q1 2009 and mid-Q2 2009, lower than the 4.6 per cent quarter-on-quarter contraction seen in Q1 2009. 'Demand for retail space fell into a state of paralysis in Q4 2008 and early 2009 as the global economy was clouded under the tint of uncertainty. However, retailers have now moved into a state of acceptance and we are seeing more leases under negotiation,' says Cushman's associate director of retail consulting and leasing Turner Canning. Cushman's average monthly rental value for prime ground floor Orchard Road retail space stood at $36.50 per square foot (psf) as at May 15, down 1.1 per cent from $36.90 psf as at end-March 2009. The latest mid-Q2 2009 figure represents a fall of 5.7 per cent since end-2008. 'While there is short-term resilience in prime retail rents, our forecast calls for a decline of a further 5-10 per cent in Orchard prime ground floor retail rentals through to the end of the year because of the generally weak retail outlook,' said Cushman's director of research Ang Choon Beng. According to Knight Frank figures, ION Orchard, Orchard Central, 313@Somerset and Mandarin Gallery are among the new malls that will add a total 1.8 million square feet of net retail space in Singapore's prime Orchard Road shopping belt from now till mid-2010, a whopping 40 per cent increase from the current stock of 4.5 million sq ft. Knight Frank managing director Danny Yeo, a veteran in the retail property consultancy sector, noted that despite the pressure from all the new shop space on Orchard Road, rents for ground floor space will probably hold up better than on the upper floors as the number of street-level units facing Orchard Road are limited in supply, whereas the supply on upper floors will be more substantial. 'So the rental drop on upper floors will be more severe than for ground floor space,' he added. Cushman's Mr Canning reckons that upper floor shop space for new and existing malls on Orchard Road could today be fetching monthly rents of about $20-25 psf, lower than around $25-35 psf a year ago. Knight Frank's Mr Yeo says it is difficult to quantify decreases in retail rents as traditionally measured on a fixed monthly psf basis. 'Increasingly, we're seeing more leases on a mix comprising slightly lower fixed rentals but also including a percentage of sales. This model cushions tenants when business is not on a level they want and enables them to tide over lean times, but once the market turns around, their total rental bill could be higher as retail sales pick up.' CB Richard Ellis director (retail services) Letty Lee observes that retailers are increasingly being challenged by the economic downturn which is driving down tourist numbers. 'Coupled with the H1N1 virus, retailers face the prospect of not being able to achieve their projected turnover. The increase in supply is another challenge. Particularly for existing retailers, they will have to brace themselves for fresh competition, fresh concepts and malls incorporating new and different retail experiences,' she added. Mr Yeo reckons that generally, retail sales at suburban malls have fared better than on Orchard Road over the past six to nine months. Retail turnover of suburban malls may have fallen by 5-15 per cent on average over this period, 'with the impact being a little bit more on fashion retailers than others such as those in groceries and F&B'. 'As for retailers along Orchard Road, for those relying heavily on tourists and big-ticket items, I wouldn't be surprised if their sales drop has been about 15-20 per cent on average over the past six to nine months, although a few may even have experienced a more substantial drop of 20-40 per cent. - 2009 May 25 BUSINESS TIMES Orchard Rd rents fall 1.9% in Q4 Prime Orchard Road rents fell 1.9 per cent quarter-on-quarter to an average of $36.10 per sq ft per month (psf pm) in Q4 2008, property firm CB Richard Ellis (CBRE) said yesterday. It is the first time these rents have headed south since Q4 2003, it said. They also contracted 0.8 per cent year-on-year, reversing their 5.4 per cent growth in Q4 2007. Prime suburban rents dipped a more moderate one per cent quarter-on-quarter to an average of $29 psf pm in Q4 2008. The last time quarterly suburban mall rents contracted was Q2 1999. For the whole of 2008, they grew one per cent. 'Retail rents were resilient in previous economic downturns (such as Sars, and the Asian Financial Crisis) due to limited supply then,' CBRE said in a report released yesterday. 'But going forward, weak demand is likely to coincide with an increase in supply. As such, downward pressure on rents is unavoidable. We expect renegotiations to commence in 2009, after the Chinese New Year festivities.' The main danger to rents, analysts say, is the new supply of retail space set to kick in over the next two years. According to CBRE, known supply for 2009-2012 is 6.36 million sq ft, with most of this - 80.5 per cent or 5.13 million sq ft - completing in 2009 and 2010. 'Developers and landlords, especially those with developments along Orchard Road, face increasing competition from the imminent supply of new malls, shops within the integrated resorts as well as refurbished shopping centres,' CBRE noted. Retailers are now more resistant to further rental increases, as local consumers, spooked by the prospects of unemployment and lower wages, have cut spending, it said. In addition, the economic recession has led to a drop in tourist arrivals. In the light of this, CBRE reckons that prime Orchard Road rents could contract 5-10 per cent in the first half of 2009. At prime suburban malls a 2-3 per cent decline is likely, it said. Suburban rents will fall more moderately due to a ready population catchment, steady demand for basic necessities and comparatively less competition from new supply. However, some resilient retailers could take the opportunity presented by lower rents and costs to expand their retail network, CBRE said. 'Certain trades will continue to thrive, despite the gloomy outlook. Supermarkets, hypermarts and F&B in suburban malls might emerge more hardy, particularly those with unique F&B themed eateries,' it said. - 2009 January 1 BUSINESS TIMES Orchard Road is Singapore’s premier shopping street and a popular destination for visitors. Stretching close to 2km, Orchard Road today has about 800,000sqm gross floor area (GFA) of shopping and entertainment attractions, complemented by hotels, offices and residences along wide shady boulevards. Coupled with a lively street culture, Orchard Road offers a unique shopping experience in a tropical setting.- URA Orchard Road is world's 13th most expensive shopping street Orchard Road has become the world's 13th most expensive shopping street - up a notch from last year - after rental rates in the area rose more than 13 per cent. Average rental rates in Orchard Road have risen to $39 per square foot per month, said Cushman & Wakefield in its annual Main Streets Across the World report. This is up 13.2 per cent from last year, making Orchard Road the 9th most expensive retail street in Asia [sic The World]. 'The strong performance of the economy, increase in tourism and overall optimism in Singapore have led to increased consumer spending and contributed to the vibrant retail scene we have seen since the economy recovered in 2004,' said Donald Han, managing director of Cushman & Wakefield in Singapore. Global brands and local retailers are jostling for a prime presence in Singapore's key retail hub, he added. 'With the limited supply in Orchard Road, there is only one direction rentals can go - up.' Main Streets Across the World tracks the rental rates of 233 of the world's top shopping locations in 47 countries. Its global league table is drawn up by taking the most expensive location in each country. The report showed that rental rates in 97 per cent of the locations have stayed stable or risen in the past year. The data is based on rent on a standard unit with a frontage of six metres and depth of 25 metres. The region showing the highest rental increases is Asia, where rents are up 20 per cent in June 2006 from a year ago. The most expensive retail area in Asia is Causeway Bay in Hong Kong, where rents are at an average US$1,134 per square foot per year. Causeway Bay is also the second most expensive area in the world, retaining its 2005 spot. Tokyo's Ginza district stayed as the world's 5th most expensive area, with average rentals of US$652 per sq ft per year. Seoul's Myeongdong district fell from 8th place to the 9th, as rentals stood at US$376 per sq ft per year. The area which saw the largest increase was Khan Market, in New Delhi. It rose 17 places to become the 24th most expensive street in the world. Sebastian Skiff, Cushman & Wakefield's head of retail in Asia, said: 'With many of the markets still considered to be emerging economies for international retail, we foresee this upward trend in rents continuing this year, matched with an improvement in the quality of product.' The world's most expensive street was New York's 5th Avenue, which averages rentals of US$1,350 per sq ft per year. - 2006 October 26 SINGAPORE BUSINESS TIMES Orchard Road is inching up the rankings among the world's most expensive shopping destinations With average retail rental of more than US$2,600

per square metre per year, Orchard Road has the world's 14th most

expensive retail space, up from number 15 last year. That is according

to annual report by

Cushman and Wakefield. Orchard Road moves up a spot from last year as average monthly rents rose 6.3% Orchard Road is now the world's 14th most expensive location in which to rent retail space, up a notch from its 15th position a year ago, according to an annual report by Cushman & Wakefield's European division. Average retail rents on Orchard Road rose 6.3 per cent year-on-year to $34 psf a month. New York's Fifth Avenue maintained its top ranking in the report by Cushman & Wakefield Healey & Baker. In second position was Hong Kong's Causeway Bay, overtaking the Avenue des Champs Elysees in Paris. Rents on Causeway Bay jumped 90 per cent year on year. Shanghai's Nanjing Road (East) was ranked 20th and Suria KLCC in the Malaysian capital, 26th. The report, Main Streets Across the World 2005, tracks retail rents in the world's top 237 shopping locations across 47 countries. The report's global league table is drawn up by taking the most expensive location in each of the countries monitored. Commenting on Singapore moving up a notch in this year's survey, Donald Han, managing director of Cushman & Wakefield's Singapore office, said: 'Demand from local and international retailers for prime shopping centres remains strong. This has pushed occupancy levels to the brink of full capacity for these malls. Prime retail rents have been on the uptrend over the past five years and are expected to continue their northward ascent for the next 12 months.' He noted that the government's recent tender launches for two sites along Orchard Road is 'a welcome relief, particularly for retailers in search for prime space'. Projects on the new sites at Orchard and Somerset MRT stations are expected to generate about 780,000 sq ft of retail space from 2009 onwards. However, Mr Han does not expect the new supply to soften prime retail rents on Orchard Road over the medium term. 'This is due to Orchard Road's solid reputation as one of the premier shopping belts in the world. Everybody wants to have a piece of Orchard Road and to set up shop here.' - by Kalpana Rashiwala SINGAPORE BUSINESS TIMES 27 Oct 2005 Orchard Road is the world's 15th most expensive shopping street. Fashion capitals New York and Paris clung to their pole positions, while Hong Kong came in third, according to a survey by Cushman & Wakefield. In its annual survey, Main Streets Across The World, Cushman & Wakefield gave the lowdown on retail rents in 45 international shopping cities. Orchard Road was the 9th most expensive spot in Asia-Pacific to set up shop with rents of US$2,363 per square metre a year. But the city-state's main shopping strip trailed behind Hong Kong's Causeway Bay, Sydney's Pitt Street Mall, Tokyo's Ginza, Seoul's Mydeongdong and Kangnam Station, Brisbane's Queen Street Mall, Melbourne's Bourke Street and Tokyo's Omotesando. It is, however, ahead of Tokyo's fashionable Shibuya. 'Most countries in the region have experienced solid economic recovery over the past 12 months and many international retailers have reacted quickly to expand their presence in places like Hong Kong, Japan and Singapore,' said C&W's Asia research director John Su. 'Rentals in these cities have resulted in significant increases since the middle of last year.' Rents in New York zoomed past the US$10,000 psm a year mark to US$10,226. Coming a distant second is Paris's famed Avenue des Champs Elysees lined with its designer wares at US$7,648. Rents in Dublin's Grafton Street leapt to US$4,103, putting it in 5th spot, up from 10th position in 2003. In Asia-Pacific, Singapore was ahead of Kuala Lumpur's Suria KLCC, Mumbai's Linking Road, Western, and Bangkok's City Centre. Singapore slipped one spot down to 15th from 14th last year. Malls along the Orchard Road stretch include Ngee Ann City, Paragon, Wisma Atria and Centrepoint. 'Despite the healthy increase of 9.6 per cent in Singapore's rents to US$31.50 per square foot a month, the other cities have outperformed that, resulting in a one-notch drop,' said C&W Singapore managing director Donald Han. 'For example, Hong Kong's Causeway Bay went up by 50 per cent and Tokyo's Omotesando jumped 70 per cent.' C&W said rents rose in two-thirds of the 45 locations surveyed with falls in about 10 per cent. 'The inflationary effect of rising oil prices will put further upward pressure on interest rates,' said C&W head of research David Hutchings. 'This may impact countries where debt is running at high levels as shoppers will not have so much money in their pockets to spend. 'Saying that, the outlook is still more optimistic than a year ago; the number of retailers looking for a unit in the world's super league of shopping streets shows no sign of abating, while retailers continue to flow into emerging markets in Europe and Asia.' - by Andrea Tan SINGAPORE BUSINESS TIMES 6 Nov 2004 LANDOWNERS

268 Orchard Rd may spice up shopping belt Ngee Ann Development (NAD) is said to be considering a redevelopment of 268 Orchard Road, which it bought for $135 million last year from CapitaLand. Sources told Business Times that it's also exploring the possibility of teaming up with owners of prominent neighbouring properties, including Crown Prince Hotel, The Heeren and Wellington Building, for a bigger redevelopment scheme fronting Orchard Road. 'However, it may be difficult to persuade neighbouring owners who may have their own priorities and agendas, to join forces. So NAD may have to be prepared to proceed with a redevelopment on its own,' says a market watcher. The Heeren is a relatively new project and its owner, the Swee Cheng group, is unlikely to see the economics of redevelopment for now. However, Swee Cheng also owns Wellington Building. This ageing asset, which is on the other side of 268 Orchard Road, is ripe for redevelopment. In front of Wellington Building is Crown Prince Hotel, with frontages on both Orchard and Bideford roads. The 21-year-old hotel, which has some retail space, could also use a revamp. Crown Prince Hotel recently saw a new stakeholder emerging when a consortium headed by US-based fund manager Farallon Capital Management settled $180 million of debt which had been extended to the hotel's owner. It remains to be seen if the consortium's stated plan of injecting fresh funds to reinvigorate Crown Prince Hotel could include partnering NAD for a joint redevelopment with 268 Orchard Road, which is 32 years old. 'This would be similar to how Singapore Press Holdings merged the Paragon and Promenade buildings to create more street-front space and a bigger presence on Orchard Road,' says a seasoned property consultant. A joint redevelopment of the four properties - 268 Orchard Rd, Crown Prince Hotel, The Heeren and Wellington Building with a combined site area of about 136,000 sq ft - could yield a new project with a maximum gross floor area, or GFA, of about 700,000 sq ft. This includes a 5 per cent bonus plot ratio that the combined site would qualify because of its size, says a property consultant. Plot ratio specifies how much GFA can be built on a site. All four sites are zoned for commercial use under the 2003 Master Plan. Some market watchers went so far as to suggest NAD could extend its tie-up to include The Ascott Group's Cairnhill Place behind the four properties. A combined integrated development of all five sites - possibly including a residential or service residence component - could generate a maximum GFA of about one million sq ft. NAD is a joint venture between Ngee Ann Kongsi and Japan's Takashimaya group and is the developer of the massive Ngee Ann City project in the 1990s. In the event that none of its neighbours are willing to join forces or sell their properties to NAD for a redevelopment, the question is whether NAD would then go ahead with redeveloping 268 Orchard Road on its own. The existing building has already optimised the site's development potential. In fact, property sources say the 20-storey building's present GFA of about 185,000 sq ft exceeds the 146,636 sq ft maximum allowed for the plot under the 2003 Master Plan. Property consultants reckon that in such a case, the authorities would usually allow a redevelopment scheme to retain the existing GFA. Even so, NAD could still benefit from redeveloping 268 Orchard Road if it manages to extract more net lettable area from the same GFA. In addition, a spanking new building should be able to fetch higher rents. Most leases at 268 Orchard Road expire by year's end, with the rest ending early next year. It would be opportune for NAD to begin a redevelopment after that - if it decides to go ahead. Or it could wait longer to persuade some of its neighbours to do a joint redevelopment. In that case, NAD could start signing leases again for 268 Orchard Road until it's time to knock down the building. The property's most prominent tenant is Citibank, occupying the basement, first, second and 16th floors. Its lease expires in November. The bank has already inked a lease to take up four levels at MacDonald House, also on Orchard Road, across the road from Dhoby Ghaut MRT station. - by Kalpana Rashiwala BUSINESS TIMES 31 Jan 05 The Brunei Investment Agency (BIA) could be the biggest winner of all the building owners in the Orchard/Scotts Road area if it redevelops its two Scotts Road properties to their maximum potential, according to a study by Jones Lang LaSalle. BIA owns Grand Hyatt Singapore and, across the road, the Royal Plaza on Scotts hotel and the adjoining DFS store. If it were to redevelop these two sites to the limit allowed under the current Master Plan, it could generate an additional 424,100 sq ft in gross floor area (GFA) beyond the buildings' combined existing GFA of 1.2 million sq ft. Far East Organization emerged second in a ranking of property owners who stand to gain the most additional space from redevelopment. The property giant and subsidiary proprietors (for buildings in which Far East has sold some strata titled units) own properties that can generate an additional 370,400 sq ft from redevelopment. The seven buildings in the Far East stable which JLL included in its survey are Far East Plaza, Lucky Plaza, Far East Shopping Centre, Orchard Plaza, Orchard Shopping Centre, Orchard Parade Hotel and Orchard Parksuites. The last two are wholly owned by Far East-controlled vehicles. Tang Holdings and listed retailer CK Tang, which own the Singapore Marriott Hotel and Tangs department store complex, ranked third. They could potentially build 236,000 sq ft extra space from redeveloping their prime site at the junction of Orchard and Scotts roads. Hotel Properties (which owns Forum, Hilton Singapore and Le Meridien hotel and mall) and Hong Fok (owner of International Building) were in fourth and fifth spots. Who's the biggest winner in terms of percentage increase in GFA? Great Eastern Life Property Services, whose Orchard Emerald could be redeveloped into a project with 130 per cent more GFA than the existing building. Hong Fok (for International Building) and Tang Holdings/CK Tang were in number two and three positions respectively, with potential gains of 73 per cent and 37 per cent in GFA. They were followed by BIA, whose potential increase in floor area for its two Scotts Road properties amounts to 35 per cent. Bonvests Holdings and its chairman Henry Ngo could see a 25 per cent enhancement from redeveloping Liat Towers and Orchard Building. While these buildings stand to reap fairly good gains in floor area from redevelopment, many other buildings in the Orchard/Scotts Road belt, are already developed to the maximum GFA allowed under Master Plan 2003 - or very close to it. In some cases, the existing floor area is more than the current limit stipulated. In such cases, however, URA may allow a new development to retain the existing GFA, subject to conditions. Factoring in all of this, JLL Singapore managing director Yu Lai Boon said that on the whole, building owners in Singapore's prime shopping district stand to achieve an increase of only 1.3 million sq ft or about 7 per cent in GFA if they were to all redevelop their properties to the Master Plan limit. This hardly leaves owners with an incentive to redevelop - considering the huge capital expenditure involved and the income they would have to forgo while their properties are being redeveloped. A developer summed things up: 'Buildings on Orchard Road are either safeguarded as hotels and therefore can't be redeveloped for other uses, or are strata-titled with fragmented ownership, making it a tough proposition for redevelopment, or have maxed out (or nearly maxed out) in permissible gross floor area. So it's not viable to redevelop.' JLL's study also showed that Far East and its subsidiary proprietors are the top owners of buildings in the Orchard area, with a combined 2.6 million sq ft for the seven properties included in the study. In second spot was Ngee Ann Development which owns 73 per cent of Ngee Ann City and which earlier this year bought 268 Orchard Road. The two buildings add up to 2.3 million sq ft GFA, although 27 per cent of Ngee Ann City was last year securitised in a deal spearheaded by German insurer Ergo. Overseas Union Enterprise (owner of Mandarin Singapore), BIA and HPL ranked third, fourth and fifth. - by Kalpana Rashiwala SINGAPORE BUSINESS TIMES 28 Oct 2004

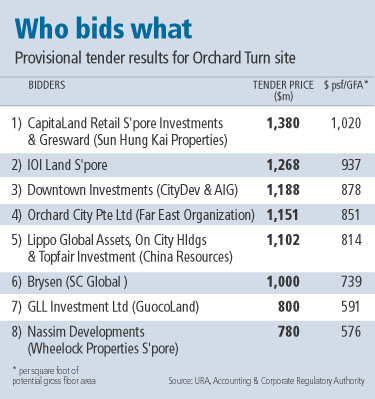

S'pore to sell more Orchard Road land Singapore said on Tuesday it would sell more land along its prime Orchard Road shopping strip for a retail mall, signalling rising confidence in its reviving property market.

This would be the Government's third commercial land sale along the thoroughfare in the last six months. The last two sites set record prices and pulled in $1.8 billion (US$1.11 billion) for state coffers. The Urban Redevelopment Authority (URA) said the 0.7-hectare plot above the Somerset subway station would be placed on its reserve list and will be up for auction only when a buyer places an opening bid that surpasses an undisclosed minimum level set by the government. At least 60 percent of the maximum 39,410 square metre gross floor area of the development will be for retail and entertainment use. -- REUTERS Rents at two upcoming Orchard malls could hit $60

psf Retailers who take up space in Orchard Road's two new malls - slated to open in 2008 - can expect to pay as much as $60 per sq ft per month (psf pm).

Yesterday, both CapitaLand's Ion Orchard and Far East Organization's Orchard Central unveiled their retail concepts. Ion Orchard - the newly named retail component of a $2 billion retail and luxury-residential project developed by Singapore's CapitaLand and Hong Kong's Sun Hung Kai Properties - will feature duplex flagship stores of six carefully-selected luxury brands. These stores will be among some 400 retail, F&B and entertainment stores occupying some 660,000 sq ft of net lettable area on eight levels. Rentals at Ion Orchard will range from '$20 to over $60 psf pm', said CapitaLand Retail chief executive Pua Seck Guan. 'We have already received offers from many retailers, but we are not in a position to disclose anything,' he said. 'We are confident that we will have close to 100 per cent occupancy by the time we open.' A soft opening is expected by end-2008, with the grand opening scheduled for first-half 2009. Over at the other end of Orchard Road, Far East Organization yesterday began officially marketing Orchard Central - almost one year after it first announced the mall's name. About 500 retailers turned up at the marketing launch. Orchard Central is expected to be completed in the third quarter of 2008. Danny Yeo, executive director of property consultancy Knight Frank, expects rents at the mall to be $18-$60 psf pm. The mall will boast a unique 'cluster' concept, with shops grouped into eight different clusters - such as Youth, Highlife and Food Haven - occupying a total net lettable area of 250,000 sq ft. There will be no anchor tenants like large departmental stores, supermarkets or cinemas. And in a first for Singapore, all shops at Orchard Central will be open until 11pm everyday. 'We told the retailers, if you sign up with us it will be from 11am to 11pm' said Vivienne Tan, president of Far East Retail Consultancy. Both malls expect foot-falls of 80,000 to 100,000 on weekdays and around 20-50 per cent more shoppers on Saturdays and Sundays. Although both malls will open around the same time, the developers maintain there will be no competition for retailers or shoppers. 'Orchard Central has a very different positioning (from Ion Orchard),' said Far East's Mrs Tan. 'And we are at the other end of Orchard Road.' Ion Orchard is located right on top of Orchard MRT station, while Orchard Central is close to Somerset MRT station. Retailers, said Mrs Tan, can have a store in each of the malls. Similarly, CapitaLand's Mr Pua said that with no major shopping centre having come up in Orchard Road for more than a decade, there will be a lot of pent-up demand for the new malls. 'In terms of location, we have a better location.' He added that CapitaLand could eventually sell its 50 per cent stake in Ion Orchard to its listed real estate investment trust (Reit) CapitaMall Trust (CMT). 'CapitaLand's strategy is very clear - we have an asset light strategy,' he said. 'At the end of the day, we would like to monetise CapitaLand's stake.' -SINGAPORE BUSINESS TIMES 17 July 2007 Orchard Road retail rents slide 2009 September 15 BUSINESS TIMES Prime Orchard Road rents fell 3 per cent quarter-on-quarter to $32.90 per square foot per month (psf pm) in Q3 2009, a new report from CB Richard Ellis (CBRE) shows. This is in line with the 2.9 per cent quarter-on-quarter fall in prime Orchard Road rents seen in Q2. However, in a reversal of the rental trend, prime suburban rents inched up 0.7 per cent quarter-on-quarter to average $28.50 psf pm in Q3 2009, driven by competition for limited availability. In view of this, CBRE now expects prime suburban rents to contract by 1-2 per cent this year, compared with its earlier estimate of a 2-3 per cent contraction. By contrast, CBRE is maintaining its forecast for a 10-12 per cent decline in prime Orchard Road rents for the whole of this year. Including a further decline of not more than 5 per cent expected for next year, the eventual rental trough for prime Orchard Road retail space should not be less than the $30 psf pm-level, the firm said. 'The last time Prime Orchard Road rents fell below $30 psf pm was from 1998 to mid-2000, when the effects of the Asian Financial Crisis were most felt,' noted the property firm in its report. 'Since the turn of the millennium, prime Orchard Road rents have shown a certain resilience. Even during the global electronics downturn and Sars in 2002/2003, these rents did not dip below $31.50 psf pm.' CBRE also noted that with the close of the third quarter, leasing activities for the new Orchard Road space have somewhat stabilised and most tenancies have been committed. Mandarin Gallery is almost 100 per cent occupied ahead of its pre-Christmas opening. Knightsbridge announced that it is 50 per cent pre- committed and expects the remaining leases to be finalised by Q3 2009. TripleOne Somerset is 60 per cent pre-let, while, across the street, 313@Somerset announced that it is 90 per cent leased ahead of its late-November opening. Two other major Orchard Road malls, Ion Orchard and Orchard Central, are already open for business - although both of them were not fully leased yet as of the last updates provided. Come 2010, the two upcoming integrated resorts will offer visitors and locals another two brand new and distinct shopping destinations, said Letty Lee, CBRE's director of retail services. 'A line-up of old and new international brands along with local offerings and emerging labels is widely expected,' she said. 'The developments will reach out to a more cosmopolitan clientele, and is likely to offer a different shopping experience from what we have encountered locally so far. It is an exciting time for the retail scene.' - 2009 September 15 BUSINESS TIMES A luxury development Scotts Square in the Orchard area registered sales of four units at a median price of $3,818 psf last month. The relatively strong sales in central Singapore were the result of 'latent demand spurred on by softening prices. - 2008 June 17 STRAITS TIMES Crowded Orchard Rd waits

for smoother lane It is at the heart of Singapore's retail sector, but with an estimated 1.5 million visitors flocking to Orchard Road every week, it could do with some serious help.

That could come soon, with the announcement of a masterplan by the Singapore Tourism Board (STB). Retailers, however, say that the traffic situation is serious enough to warrant an in-depth overhaul, rather than just cosmetic surgery. STB would not say what is in store except that details of pedestrian mall improvement works would be released shortly. Sources, however, say that there are plans to reduce the number of lanes on Orchard Road and widen the pedestrian mall. And there could also be a separate initiative by the government to provide covered linkages between the malls. It is understood that STB had recently engaged Orchard Road stakeholders for their views and is now in the process of re-evaluating this feedback. The $40 million makeover was first mooted in Parliament in early 2005. A year later, the inter-agency Orchard Road Rejuvenation Taskforce (ORRT) said that the work to transform the shopping strip would begin in early 2007. Work has yet to begin in earnest - save for a crosswalk lighting project at Bideford Junction - and the hold-up appears to be the proposed plan to reduce the number of lanes in Orchard Road, as well as the cost of improved infrastructure like covered linkways. Singapore Retailers Association executive director Lau Chuen Wei said that what retailers and businesses want is a solution to the traffic flow, 'so that people going to Orchard Road can navigate the junctions, side roads and merging traffic more easily'. She added: 'Closing off a lane to make way for pretty trees and lamp-posts is not really a solution.' There are no secondary service roads for certain stretches of Orchard Road, so goods deliveries have to be made via the main thoroughfare, clogging up lanes. 'What Orchard Road needs urgently is an in-depth study of traffic flow to ease congestion. It's not a matter of imposing toll charges, but actual infrastructure,' Ms Lau said. There have been suggestions that a whole system of covered linkways and underground passages be built to improve connectivity, but Steven Goh, spokesman for the Orchard Road Business Association, notes that some of the existing underground links are not really utilised. Cushman & Wakefield (C&W) managing director Donald Han reckons $40 million may be enough for 'cosmetic surgery' like the provision of street furniture and interactive street light crossings but may not be enough for 'major transplant operations' such as providing more subsidies for shopping centre owners to link buildings. Orchard Road is nevertheless popular. In a recent C&W report, it was noted that Orchard Road sees about 1.5 million visitors every week. And even if it is not the most popular shopping street in the world, it is at least ranked by C&W as the 13th most expensive in terms of rental. Mr Han said: 'To be fair, the Urban Redevelopment Authority and STB have gone a long way in their efforts to revitalise Orchard Road.' There are now street vendors, kiosks, restaurants, coffee bars on the walkways. 'In the past, these were not allowed,' he added. The real revamp of Orchard Road is likely to be in the hands of developers like Hong Kong-based Park Hotel Group (PHG), which bought the old Crown Hotel in 2005 and now plans to redevelop it into a high-end shopping mall and boutique hotel. For PHG director Allen Law, the proposition to buy and redevelop the old hotel is a no-brainer. 'Orchard Road is one of the best roads to walk along - the weather is nice, the air is clean, and there is a lot of greenery to enjoy. People don't want another air-conditioned mall filled with all the standard brand names; they want an experience. Focusing on the uniqueness is vital to success,' he said. CapitaLand is another developer with a big stake in Orchard Road through its upcoming Ion Orchard shopping mall. CapitaLand Retail CEO Pua Sek Guan is equally bullish on the strip's future. And as iconic as Ion is going to be, Mr Pua understands that the Orchard Road experience 'cannot be re-created in one mall alone'. Although Ion will not have a covered walkway to the neighbouring mall, Mr Pua said CapitaLand will be creating a 3,000 square metre public space fitted out with water features, LED screens and audio systems for public entertainment. The cost? 'It's not a small sum,' he said. Tangs CEO Foo Tiang Sooi says he is all for 'strengthening the precinct' too. The revamp, when the details are announced, may indeed have some adverse changes but Mr Foo says: 'One has to take a broader view.' - 2007 August 18 SINGAPORE BUSINESS TIMES The Orchard Road effect The Orchard Road area will be the centre of

property development for the next few years, having chalked up 39

collective sales of residential redevelopment sites in 2006. CB Richard

Ellis reckons the sites could yield about 3,700 new high-rise homes. But

what they will cost is harder to predict. "How the prices of forthcoming

high-end projects in the core Central Region move depends on the

strength of the economy and the support from high net-worth

individuals," says CBRE director (residential). Here's where the 39

collective sales sites are: